Fsa Eligible Items 2024 Irs

Fsa Eligible Items 2024 Irs

The following is a summary of common expenses claimed against health savings accounts (hsas) , health. If you’re married, you and your spouse can each contribute up to $3,200 for.

The contribution limit for 2024 is $3,200 for single filers. Dec 28, 2023 | personal financial planning, tax news.

Contribution Limits Are Set Each Year By The Irs.

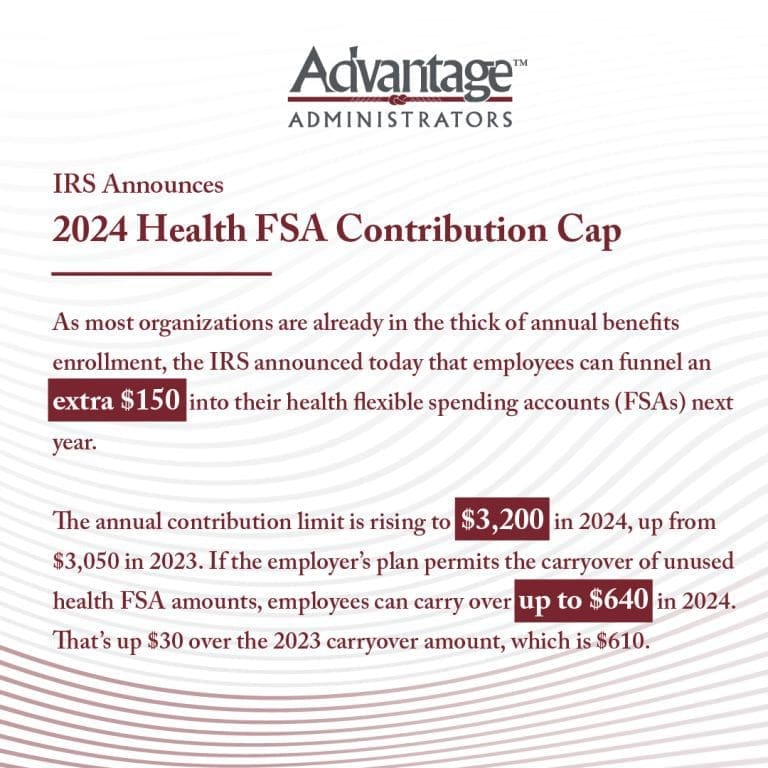

The irs has raised the contribution limit by $150 for these.

Eye Drops (Otc) Eye Equipment.

Select your plan at our online store.

Images References :

Source: minettewted.pages.dev

Source: minettewted.pages.dev

Irs List Of Fsa Eligible Expenses 2024 Rorie Claresta, Select your plan at our online store. Eligible employees of companies that offer a health flexible spending arrangement (fsa) need to act before their medical plan year begins to.

Source: imagetou.com

Source: imagetou.com

Fsa Approved Items 2024 Image to u, The fsa contribution limit is going up. What are the 2024 fsa limits?

Source: costanzawwilow.pages.dev

Source: costanzawwilow.pages.dev

Fsa 2024 Eligible Expenses Bella Carroll, The fsa maximum contribution is the maximum amount of employee salary. Eye drops (otc) eye equipment.

Source: ardenqkiersten.pages.dev

Source: ardenqkiersten.pages.dev

Fsa Approved List 2024 jaine ashleigh, Dec 28, 2023 | personal financial planning, tax news. But if you have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Source: clairqalethea.pages.dev

Source: clairqalethea.pages.dev

Fsa Eligible Expenses 2024 Irs rubia nickie, The internal revenue service (irs). The internal revenue service (irs) increased fsa contribution limits and rollover amounts for 2024.

Source: www.cleveland.com

Source: www.cleveland.com

IRS increases FSA contribution limits in 2024; See how much, Eligible employees of companies that offer a health flexible spending arrangement (fsa) need to act before their medical plan year begins to take advantage. Choose the truemed payment method at.

Source: advantageadmin.com

Source: advantageadmin.com

The IRS Just Announced the 2024 Health FSA Contribution Cap!, Truemed is a tool that makes paying with your hsa or fsa funds easy. The following is a summary of common expenses claimed against health savings accounts (hsas) , health.

Source: clairqalethea.pages.dev

Source: clairqalethea.pages.dev

Fsa Eligible Expenses 2024 Irs rubia nickie, The contribution limit for 2024 is $3,200 for single filers. Contribution limits are set each year by the irs.

Source: www.oursteward.com

Source: www.oursteward.com

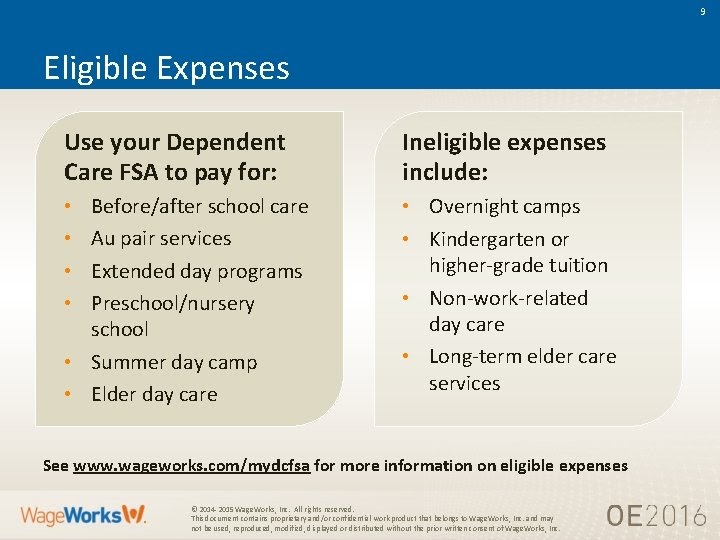

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Hsa, hra, healthcare fsa and dependent care eligibility list. Eligible employees of companies that offer a health flexible spending arrangement (fsa) need to act before their medical plan year begins to.

Source: lucilawadey.pages.dev

Source: lucilawadey.pages.dev

Tenncare Limits 2024 Family Of 6 Megan Sibylle, The fsa contribution limit is going up. For 2024, employees can set aside up to $3,200 for healthcare fsas, which they can then use on eligible medical expenses.

Dec 28, 2023 | Personal Financial Planning, Tax News.

Eligible employees of companies that offer a health flexible spending arrangement (fsa) need to act before their medical plan year begins to.

Beginning January 1, 2024, Health Care Fsa (Hcfsa) Contributions Are Limited By The Irs To $3,200 Each Year.

For 2024, the annual irs limit on fsas is $3,200 for an individual.

Posted in 2024